Grain Market Trading: Enabled by CropProphet

Grain market futures traders understand that weather events significantly impact the price of corn and soybean futures. After all, weather is the dominant cause of year-to-year variability in corn and soybean yield and production.

CropProphet users have access to a weather-based solution to forecast end-of-season US corn and soybean yield and production, which the USDA reports each year. CropProphet users can create a systematic grain trading strategy based on our data. Despite the emergence of grain yield forecast products such as CropProphet, grain markets remain sensitive to daily changes in weather information and forecasts.

This post examines the relationship between daily weather forecast changes and the price reaction of grain markets.

Grain Futures Trading: Impact of Weather Forecasts

Our analysis focuses on determining how well day-to-day changes in the weather forecast models explain daily grain futures price changes. We have all seen periods in prior years when either the ECMWF or the GFS temperature forecast shifts over a few days in mid-July towards forecasting higher grain belt temperatures and the grain futures market response with increased market volatility. We seek to understand if value-added weather forecast information enables improved trading opportunities during these volatile times.

We’ve also examined the impact of daily yield forecast changes on daily grain trading.

Grain Futures Data

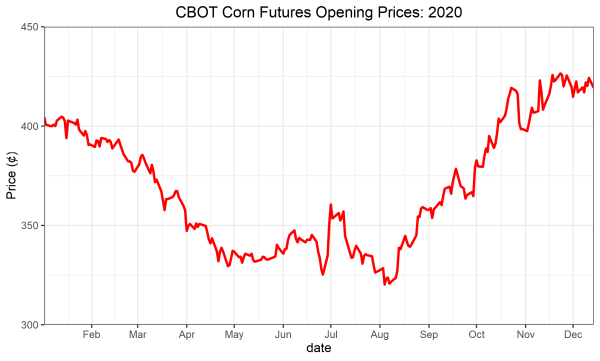

The analysis uses the widely available Chicago Board of Trade grain futures price information, specifically for corn and soybeans. We use both the 2021 January soybean futures prices and a 2020 continuous contract futures price in our analysis.

We calculated a daily price change as the daily close minus the daily opening price. In other words, we calculated the change in corn and soybean futures prices during regular trading hours.

We are, therefore, excluding any overnight change in price that may reflect an immediate response to the overnight change in the weather forecast.

Grain Weather Forecast Data

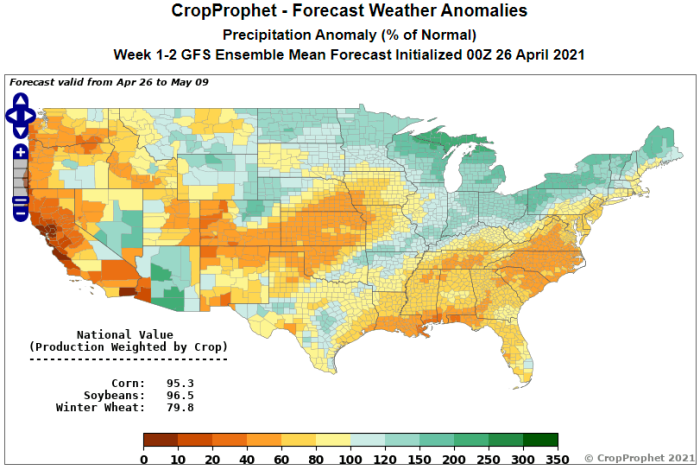

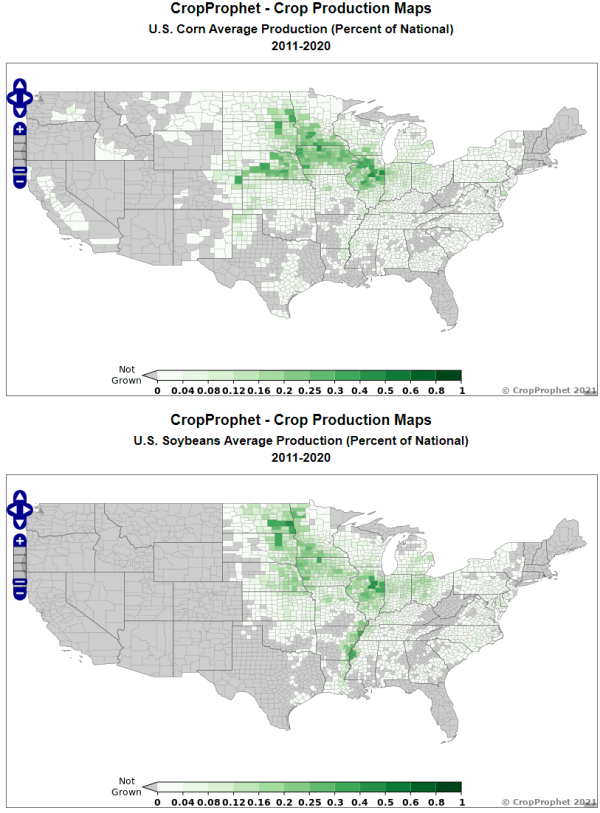

Corn and soybeans are grown in approximately 1600 and 1500 counties in the US, respectively. Interpreting the likely impact of a weather forecast is complicated. Crop production weighting a weather forecast greatly simplifies weather forecast interpretation. Crop prophet weighting means we multiply the weather forecast in a county by that county’s contribution to national crop production. We then sum up all counties to create the production-weighted forecast.

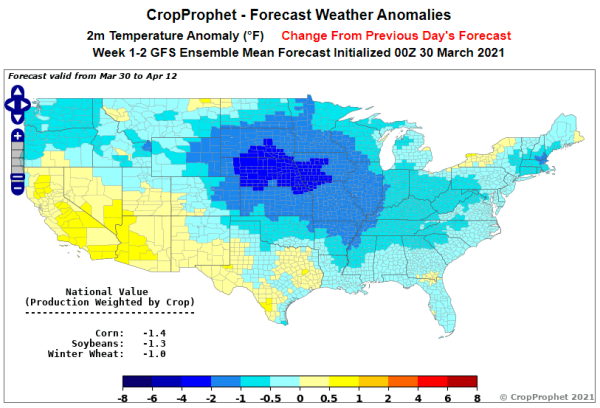

We apply this technique to daily temperature and precipitation forecast changes in the NOAA Global Ensemble Forecast System (GEFS) and the European Center for Medium-Range Weather Forecasting (ECMWF). The result transforms a detailed weather forecast map into a single crop forecast index. We show the production weighting function for corn and soybeans below.

Production-Weighted Grain Weather Forecast

We examine the ability of each day’s grain production-weighted weather forecast to impact daily grain futures prices.

Specifically, we calculated the daily change in the 15-day 00 GMT ECMWF and the GEFS forecasts from 2019 and 2020 between July 15 and September 15, weather-sensitive periods in grain markets. The calculation was such that today’s 0-15-day forecast was compared to yesterday’s 1-16-day forecasts so that the periods overlapped.

The weather forecast models initialized at 00 GMT are available early in the morning US Central Time. The information is available each morning before the market opens.

Grain Futures Trading: Implications

We evaluate the trading model using a simple evaluation.

If the precipitation forecast declines from the previous day, the end-of-season crop supply and price should decline. A day in which this occurs is labeled “correct.”

If the precipitation forecast increases from the previous day, the end-of-season crop supply should increase, and the price should decrease. A day in which this occurs is labeled “correct.”

The reverse relationships are “incorrect.”

This simple model evaluates the relationship between the daily change in production-weighted weather forecasts and grain futures prices.

Grain Trading Weather Forecast: Result

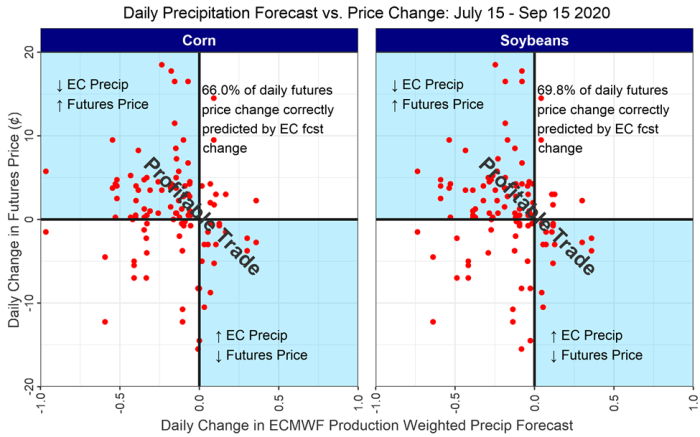

We use the simple trading model to test the sensitivity of grain futures prices to ECMWF daily precipitation changes during the 2020 crop season. The results indicate the corn and soybean production weighted daily change in the ECMWF precipitation forecast from July 15 to September 15, 2020, correctly predicted the direction of grain futures prices 66.0% and 69.8% of the time for corn and soybean, respectively.

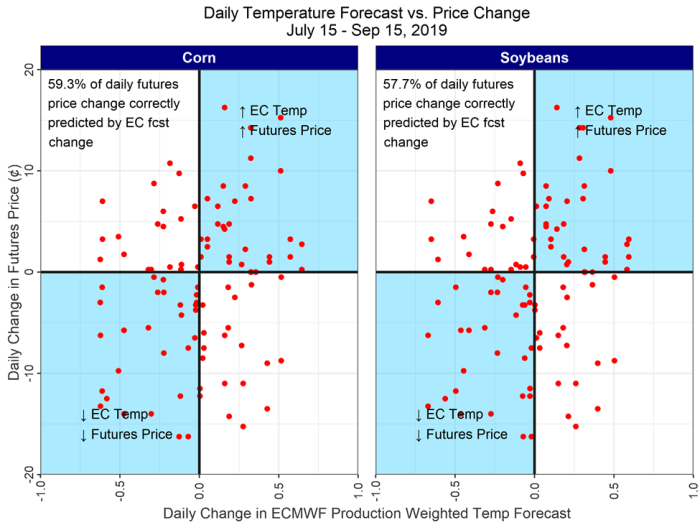

We consider the same simple trading model for the change in the ECMWF temperature forecast but with the “correct” relationship reversed. In this case, we show the same analysis for 2019.

For 2019, the ECMWF daily temperature forecast change explains 59.3 and 57.5% of the daily price change, respectively. We did not find a strong relationship for 2020 daily temperature forecasts.

Extreme temperatures during the second half of Summer can concern grain markets. Weather forecasts changing towards higher forecast temperatures may indicate adverse supply risks.

The graphic suggests that ECMWF changes towards warmer temperature forecasts result in positive daily corn and soybean price increases. However, this analysis is based on a one-year analysis, and further work is required to analyze the temperature impact of weather forecast models fully.

Using CropProphet: The Weather Signal

Fortunately, CropProphet provides production-weighted weather forecast information to help you take advantage of this information. We also calculate the grain production weighted daily change in ECMWF and GFS model temperature and precipitation forecasts.

We also calculate the daily change in the weather forecast for each variable and make it easily accessible in CropProphet, as shown below.

CropProphet Annual Model Update

CropProphet has been improved each year since 2009, when we started crop yield modeling. The production-weighted weather forecast is not a new functionality, but its value is evident based on the information presented in this post. CropProphet is a valuable tool to support your daily grain trading activities.

We’ve also recently published an analysis using CropProphet to forecast the monthly USDA NASS corn and soybean yield forecast changes, another widely used source of information to enable grain futures trading.