Canadian Oats Market: Market Information Provider

Randy Strychar, President of Oat Information, advises millers, traders, and industry participants in the global oat market. In summer 2025, his clients faced substantial weather-related uncertainty: would Canadian oats rebound with decent yields, or would lingering dryness limit production?

The oat market consensus leaned toward optimism. Field tours and local press, like The Western Producer, reported ‘pleasant surprises’ in crop conditions. Comments Randy received from multiple clients during July and August noted that,” despite late-May and early-June dryness, the impact on oats was less severe than expected. Timely rains in late June helped stabilize crops, leaving conditions mixed but not in crisis.”

At the same time, crop tours suggested oat yields of nearly 95 BPA (versus a five-year average of 86.2 BPA). Optimism was in the air.

Oats Weather Risk is Reputation Risk?

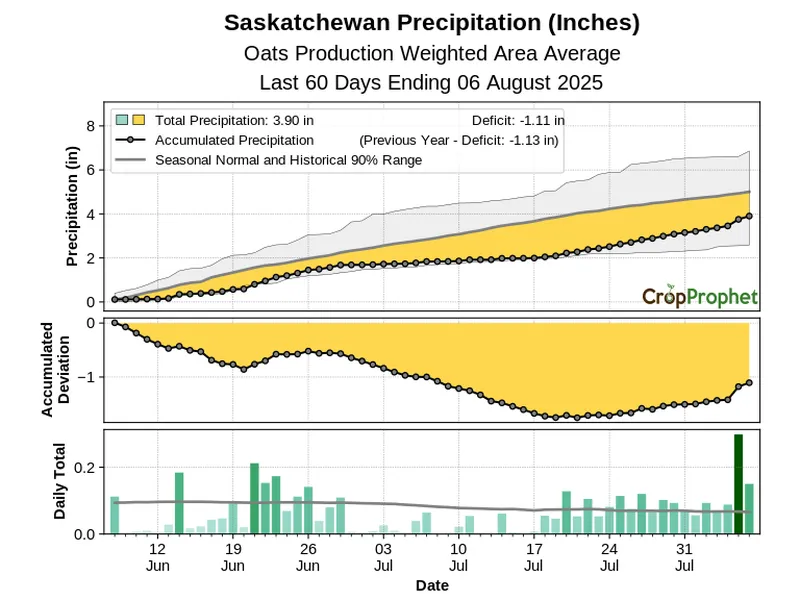

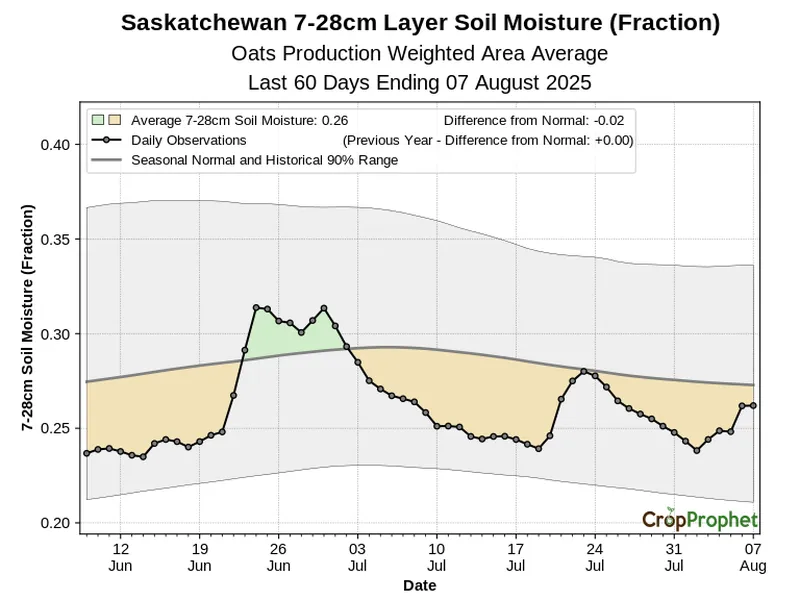

Despite these reassuring signals, Randy was skeptical. CropProphet’s weather-driven analysis told a different story. Precipitation across Saskatchewan’s oat belt, particularly in major oat production regions, was sharply below normal through much of June and July, with substantial soil moisture deficits persisting into August in some regions.

“We were taking heat for my concern all summer from customers because they didn’t believe the Canadian Oat crop was experiencing a weather risk. But the detailed CropProphet weather data consistently pointed to a problem,” Randy said.

Randy’s analysis of the oat crop weather risk convinced him that oats production would be lower than widely assumed, likely closer to the average. The challenge was credibility. Could Randy rely on CropProphet’s data to challenge market consensus and withstand pushback from clients and peers who preferred the more optimistic narrative?

Statistics Canada’s August model-based estimate pegged oat yields at 90.7 bushels per acre (BPA), which is near the five-year average, and what Crop Prophets data suggested to Randy.

Supporting Canadian Oats Market Analysis: CropProphet

CropProphet provides Canadian grain market participants with localized weather and soil data focused on the country’s crop-growing regions. The regional specificity of the weather data enabled Randy to zoom into the oats growing regions that mattered most.

Randy leaned on CropProphet’s production-weighted, census agricultural region and provincial-level weather analysis tools. Unlike traditional sources that provide generalized Canadian prairie-level information, CropProphet provides detailed, crop district diagnostics (see Canadian oats production by Province rankings here): Saskatchewan oats production weighted precipitation data (Figure 1) showed conditions dipping below the historical 90% range in early July indicating near record dryness.

Figure 1. Saskatchewan oats crop accumulated precipitation during the summer of 2025 showing increasingly dry conditions.

Figure 2. Saskatchewan soil moisture conditions during the summer of 2025 showing the development of dry conditions.

The lack of precipitation resulted in below normal on soil moisture (Figure 2) the critical time of the oats crop season.

These insights were directly incorporated into Randy’s client briefings. He paired CropProphet’s visualizations with his own market commentary, giving millers and traders a grounded perspective when others were swayed by anecdote and optimism.

Randy couldn’t understand why the rest of the market was so positive about the 2025 Oats crop. He eventually realized it’s because the rest of market was not using CropProphet.

Randy said, “The detailed drill-down capability to a local region level, balanced with provincial-level analysis and the consistency of the objective weather information CropProphet provides, supported my convictions. It avoids the risks of leaning too heavily on local observations, which—while valuable—can sometimes miss broader trends that the “detailed” data reveals”

Canadian Oats Yield Analysis: Declines

When StatsCan’s subsequent reports came out, they validated CropProphet’s warnings: oat yields were significantly lower than many expected earlier in the season. CropProphet’s data indicated likely stress from missed rains. By trusting CropProphet, Randy protected his credibility with clients in a skeptical market, provided early warning of production risk weeks before official numbers, and demonstrated the power of localized, weather-driven risk analysis. As Randy put it just before harvest: ‘Some big players in the oat market questioned my analysis, which was based on CropProphet’s Canadian oats weather data. But when the official numbers came out, they mirrored CropProphet exactly. That level of local detail separated it from anything else we’ve seen.‘

Staying Ahead of Canadian Oats Weather Risk

CropProphet empowers grain market analysts and traders with early, reliable, localized crop weather risk analysis and selected crop forecasts. By identifying oat yield stress before it appeared in official statistics, CropProphet helped OatInformation give its clients a decisive edge. In volatile grain markets, timing is everything—and CropProphet delivered.